- by Yueqing

- 07 30, 2024

-

-

-

Loading

Loading

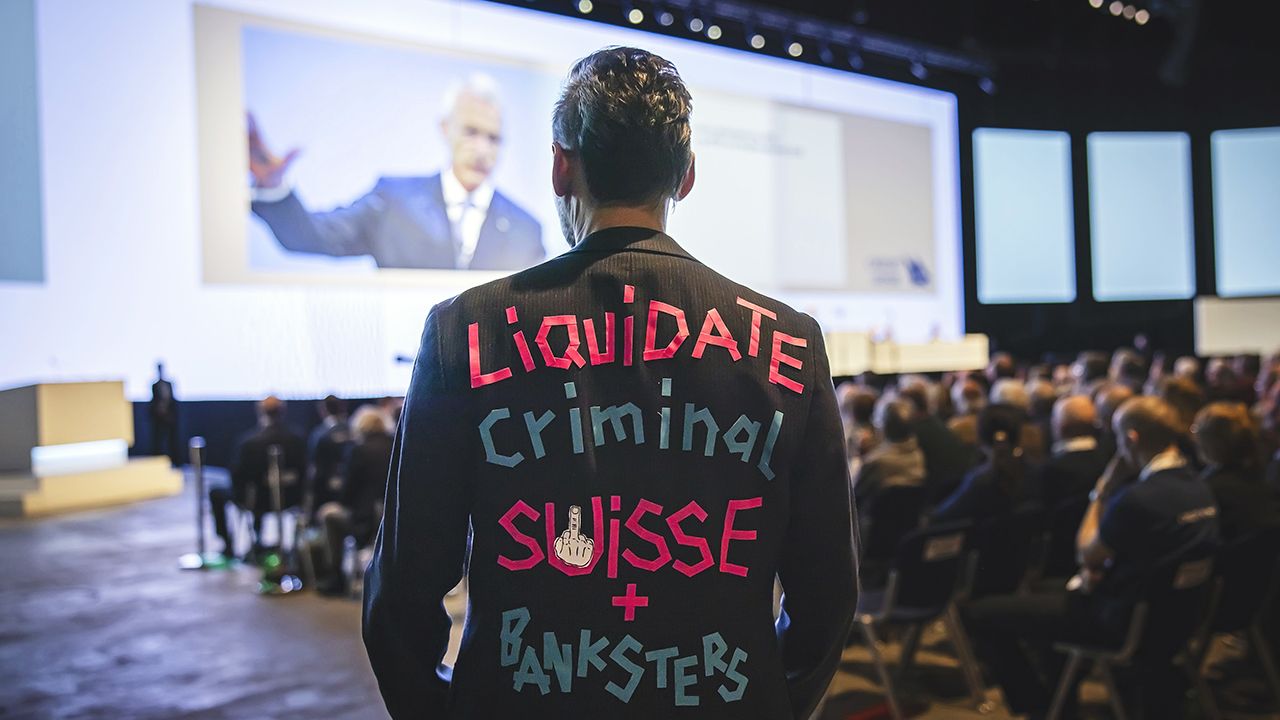

When swissubs regulators announced that from the brink of collapse on March 19th, the troubled bank’s shareholders seemed lucky to avoid a total loss on their investment. Yet if any of the 1,700 who entered Zurich’s Hallenstadion on April 4th for the firm’s final annual general meeting were relieved, they did not show it. Tickets to the historic event were cheap: the terms of the rescue deal, which was agreed without a shareholder vote, valued Credit Suisse’s shares at a mere SFr0.76 ($0.84).Opening eulogies were delivered by Axel Lehmann, the firm’s chairman, and Ulrich Körner, its chief executive. Votes to award bosses extra pay and absolve them of blame for actions taken during the past financial year were scrapped, along with the bank’s dividend. Five members of the board did not seek re-election. The remaining seven have the unenviable task of guiding the bank through its twilight months before the deal closes later this year. Although Glass Lewis, a proxy adviser, and Norges Bank, a big shareholder, opposed Mr Lehmann’s re-election, he was spared the boot in the shareholder vote.