- by Yueqing

- 07 30, 2024

-

-

-

Loading

Loading

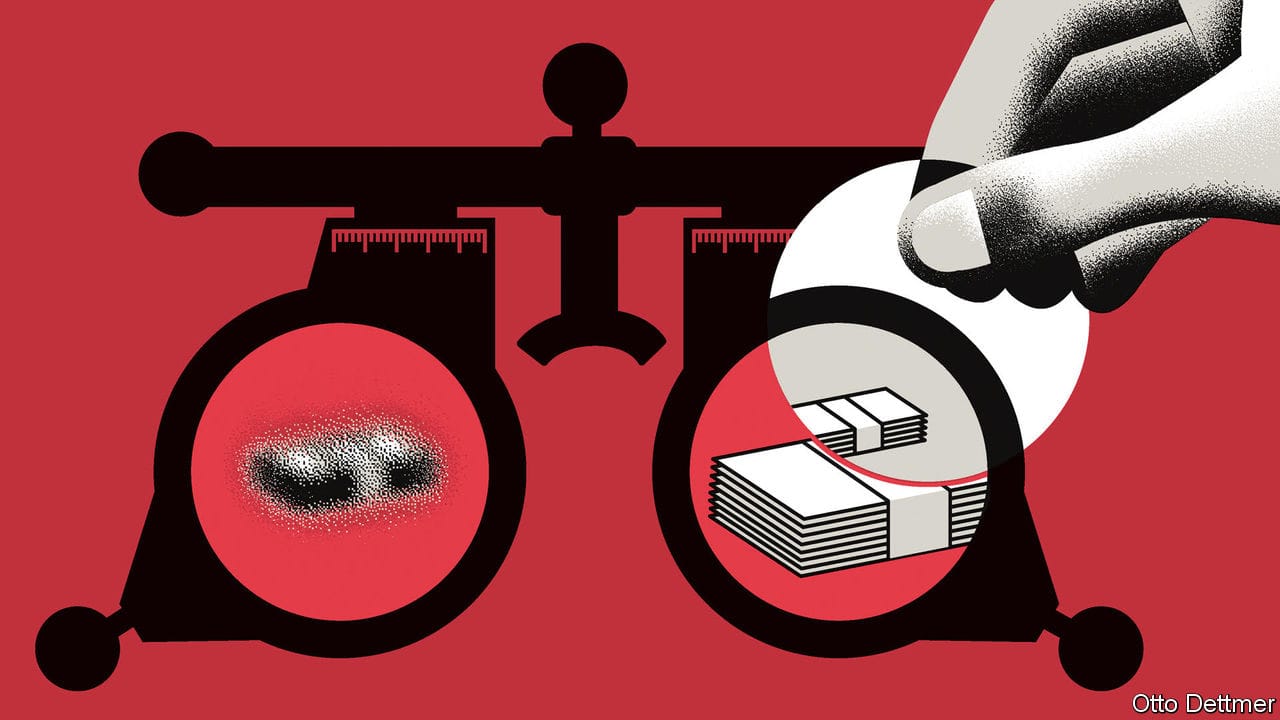

FOR ECONOMICS writing—a genre that stylistically is often closer to computer manuals than to literature—a discussion paper recently posted on the Federal Reserve’s website is a blessed relief. Jeremy Rudd, a Fed researcher, includes quotations from William Butler Yeats and Dashiell Hammett. He uses such phrases as “ill-tempered pettifogging” and “arrant nonsense”. And, as if channelling David Foster Wallace, he has fun in his footnotes, notably one in which he casually observes that mainstream economics may serve as “an apologetics for a criminally oppressive, unsustainable and unjust social order”. Little wonder his paper has become, by central-bank standards, a social-media sensation.But it is the substance, not the style, of Mr Rudd’s paper that is most provocative. He directs his arguments at an axiomatic idea in economics: that expectations determine inflation. The conventional story is straightforward. When workers expect prices to rise, they demand higher wages. When firms expect costs to rise, they set higher prices. In both cases, inflation becomes a self-fulfilling prophecy. Central bankers’ task is to pin down expectations at a low, stable level. If they succeed, they can control inflation.