- by Yueqing

- 07 30, 2024

-

-

-

Loading

Loading

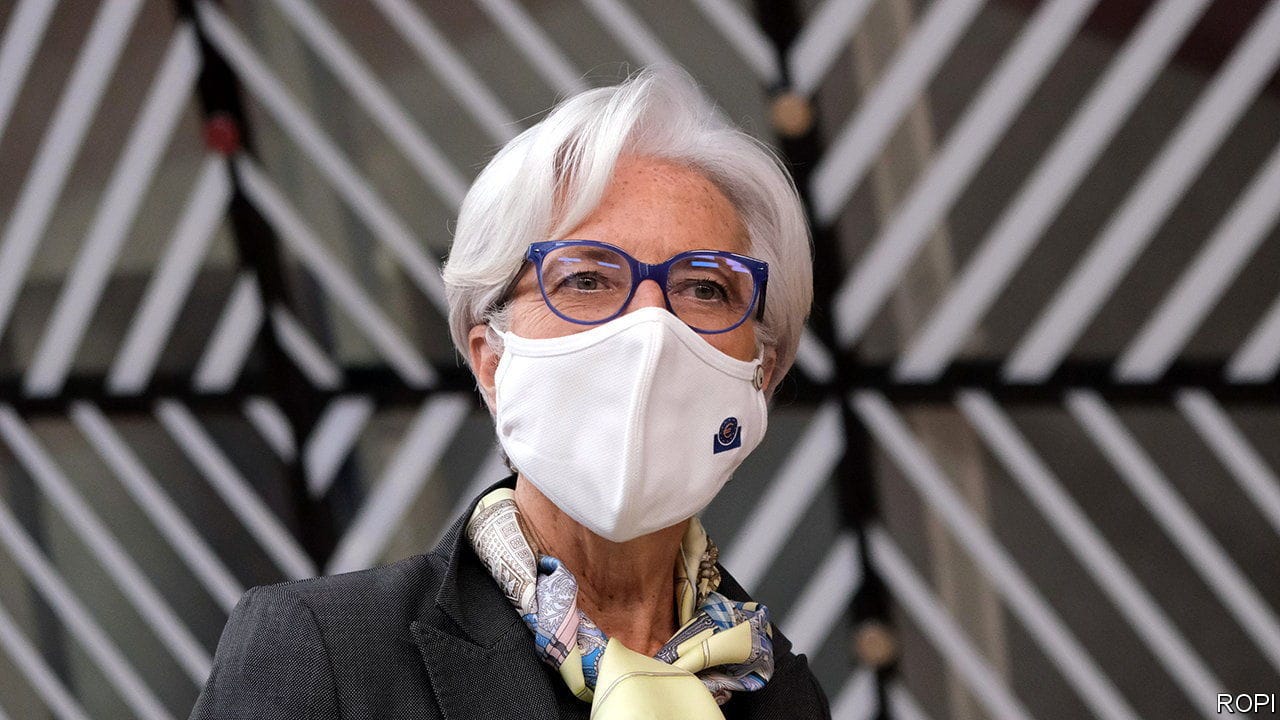

FOR MOSTECBECB of its 23 years of life the European Central Bank () had the fuzzy inflation target of “below, but close to, 2%”. No one knew what precisely that meant, but the consensus among economists was that the bank was aiming for inflation in the region of 1.7-1.9%. In any case stubbornly low inflation rendered the question almost academic. Average annual inflation in the euro area since 2013 has been just 0.9% compared with 1.9% in America, even though interest rates are below zero and the has hoovered up government and corporate bonds for years in an attempt to gin up the economy.The bank’s struggle to attain its target has prompted some soul-searching. Last year Christine Lagarde, its president, launched a review of its strategy, which held “listening” events and pored over academic papers. Its conclusions were announced on July 8th. The bank plans eventually to incorporate the impact of climate change in its models and, potentially, to reflect climate considerations in its asset purchases. It also intends to pay attention to the cost of owning a house when it studies inflation (in contrast to practice in other rich countries, this is not included in the euro area’s measure of consumer prices). And it unveiled a new symmetric inflation target, of 2%.