- by Yueqing

- 07 30, 2024

-

-

-

Loading

Loading

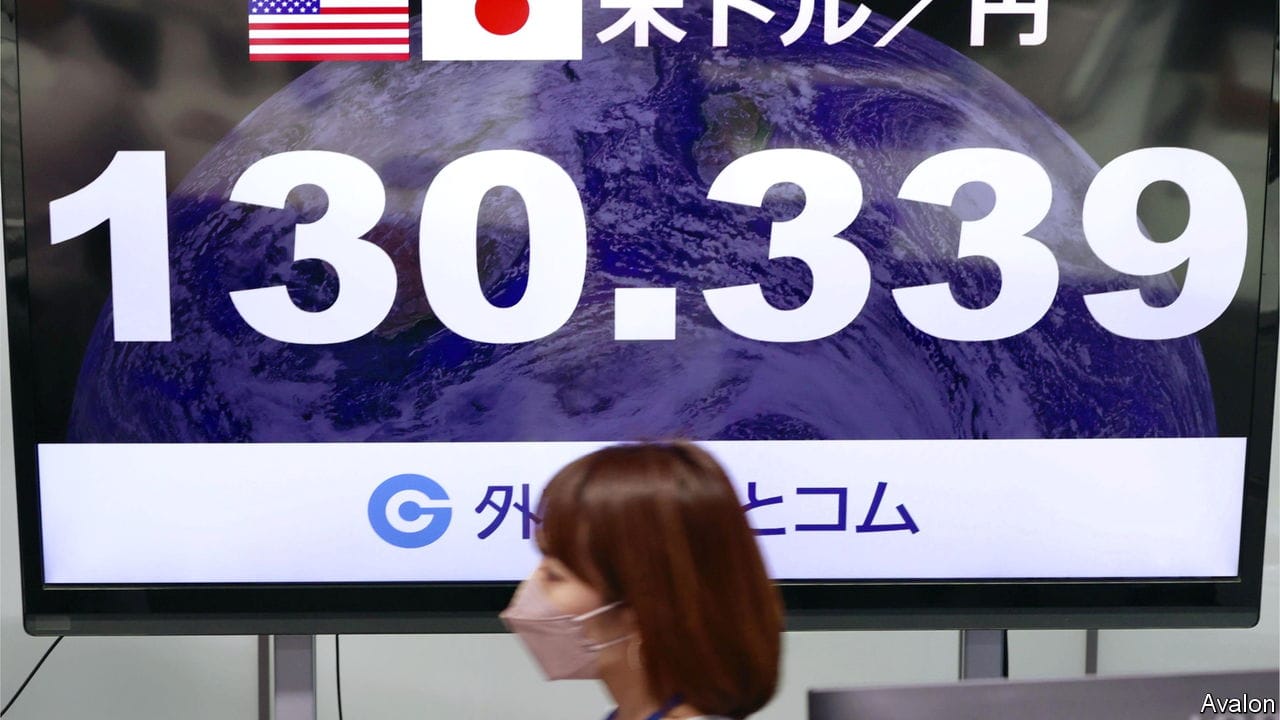

THELASTBJBJBJBJ time the Japanese yen dipped below 130 to the American dollar, in 2002, China’s economy was smaller than France’s, Vladimir Putin was meeting Western officials with a smile, and Eminem, a rapper, was atop the pop-music charts. The , first reached on April 28th and then every day since, has been precipitous: it stood at just 115 to the dollar at the start of this year. Japanese policymakers have begun to fret, leading markets to speculate about whether they will intervene to halt the fall. That would probably prove futile: deep forces are driving the yen’s depreciation.The most important one is the widening gap in interest rates between Japan and America (see chart). While prices have risen sharply in America, has remained below the Bank of Japan’s (o) 2% target. And though inflation may touch that mark later this year, the o reckons it is being fuelled by one-off increases in costs; idiosyncrasies of Japan’s labour market have meant limited wage growth. As a result, even as the Federal Reserve has begun tightening rates, the o has maintained its ultra-loose stance. At a monetary-policy meeting last week, the o reaffirmed that direction, pledging to keep buying ten-year bonds to help control the yield curve. With more money to be made holding American bonds than Japanese ones, investors have snubbed the latter, dampening demand for the yen.