- by Amy Yee

- 01 15, 2026

-

-

-

Loading

Loading

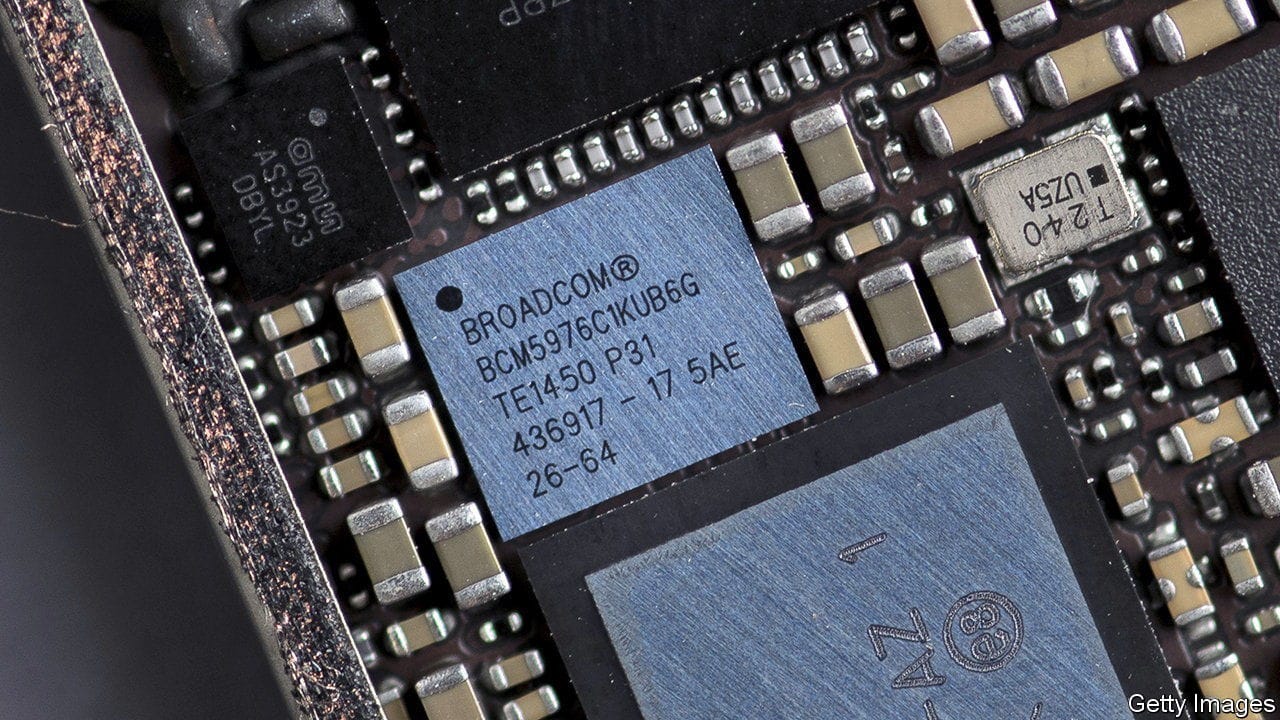

is a good time for buyers. Look at the tech industry. The Nasdaq, a tech-heavy index, has fallen by 30% from its peak in November and a flurry of deals are under way. Microsoft is working on the $69bn purchase of Activision Blizzard, a videogame maker. Since March, Thoma Bravo, a private-equity firm, has spent $18bn on two enterprise-software firms. Elon Musk is—perhaps—about to purchase Twitter, a social network. The latest big tie-up looks unusual. On May 22nd Bloomberg reported that Broadcom, predominantly a semiconductor maker, worth $214bn, is planning to buy ware, an enterprise-software firm. If the deal goes through, it could be worth $60bn. A chipmaker buying a software firm may seem strange. But Broadcom has done the same thing in the past with striking success. Can it repeat the trick?