- by Amy Yee

- 01 15, 2026

-

-

-

Loading

Loading

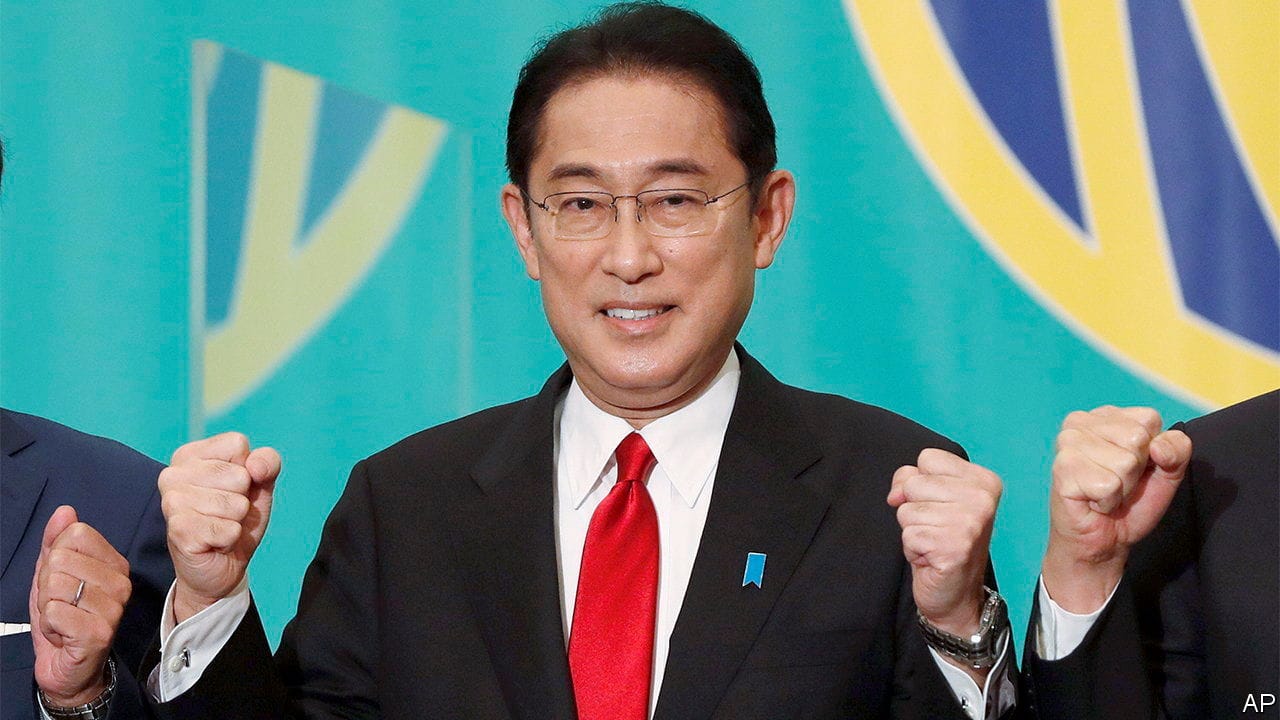

KISHIDA FUMIOSBISBISBI, Japan’s new prime minister, has voiced no opposition to the corporate-governance reforms of Abe Shinzo. His predecessor’s efforts to make Japanese companies more focused on shareholder returns and less beholden to insider management were central to his economic reforms. But nor has Mr Kishida said much in their favour. Proposals for tax breaks for companies that increase wages have made it into the manifesto of his ruling Liberal Democratic Party, as have references to the importance of stakeholders over shareholders. That will worry those who think Japanese shareholder capitalism has not yet gone far enough.A new test will provide more evidence of Mr Kishida’s attitude to changing the behaviour of Japan Inc. In September Holdings, a financial conglomerate, made an unsolicited takeover offer which would raise its holding in Shinsei Bank, a regional lender, from around 20% to 48%. has ambitions to create a Japanese megabank through alliances and acquisitions. The consolidation of the country’s multitudinous small banks is precisely the sort of change the corporate-governance reforms were implemented to facilitate. Shinsei Bank opposes the offer as it stands, making it a hostile bid, still an extremely rare event in Japan. It is willing to defend itself using a “poison pill” which would dilute ’s holding, subject to shareholder approval in a meeting on November 25th.