- by Yueqing

- 07 30, 2024

-

-

-

Loading

Loading

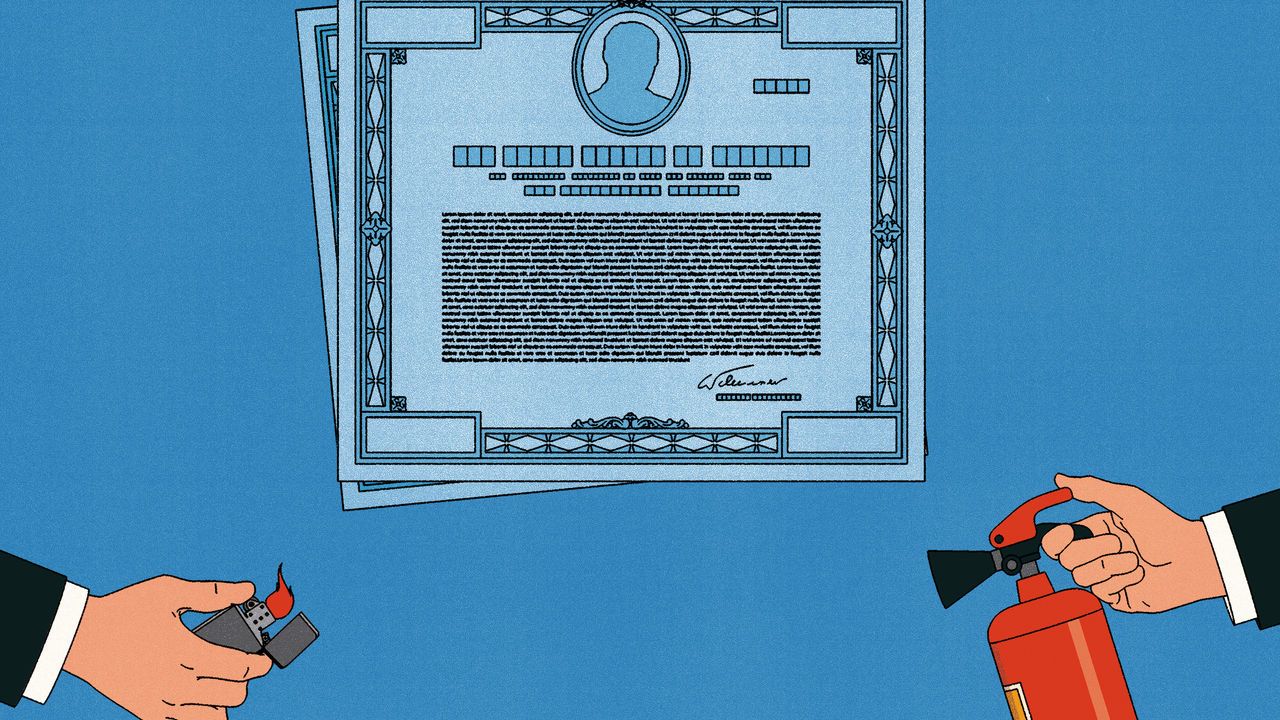

Although buying inflation-protected bonds to protect against inflation does not seem unreasonable, it would have been a spectacularly unprofitable move during the latest bout of inflation. One hundred dollars put into inflation-protected Treasuries in December 2021, when investors first saw American core inflation reach 5%, would have been worth just $88 a year later. Even cash under the mattress would have done better.Safe to say, inflation-linked bonds are in trouble. Investors pulled $17bn from exchange-traded funds tied to them last year. Canada announced plans to cease issuing them in 2022; Germany did the same in November. Sweden is considering its options. Yet these countries are making a mistake. So long as their purpose is not misconstrued, inflation-linked bonds serve a vital function for markets and the governments that issue them.