- by Amy Yee

- 01 15, 2026

-

-

-

Loading

Loading

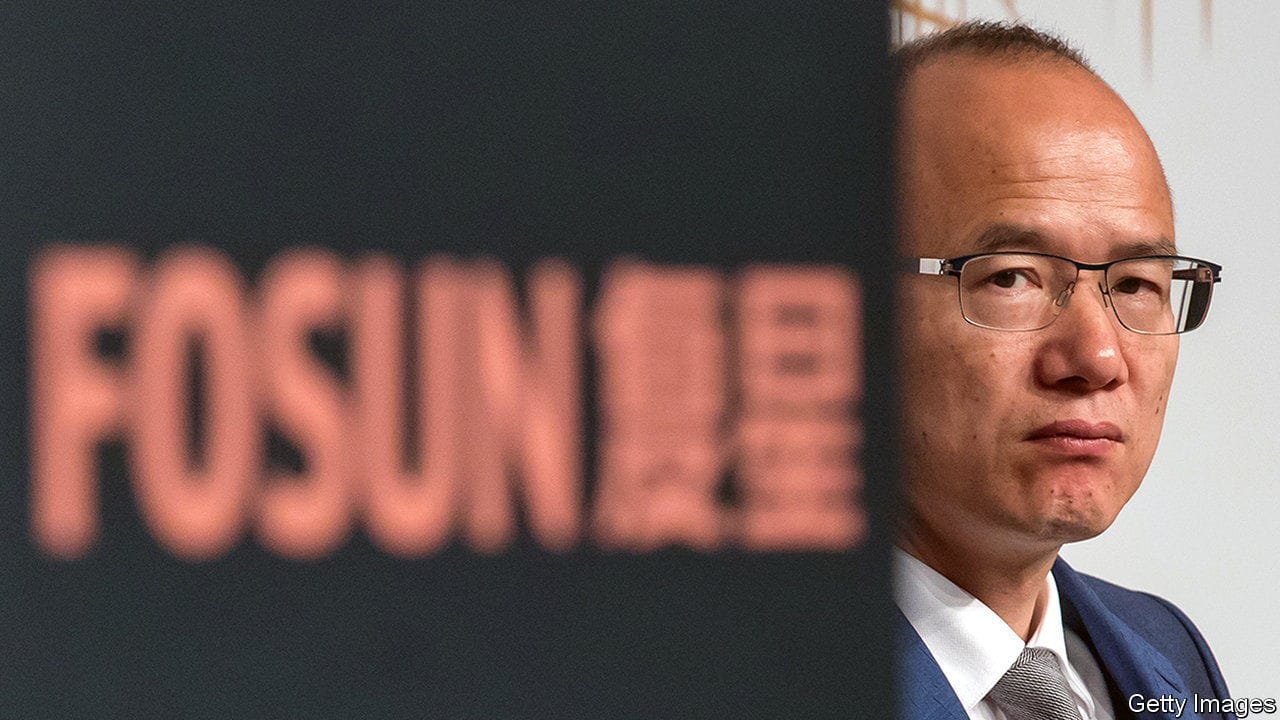

few years Guo Guangchang, chairman of Fosun, a Chinese conglomerate, has watched as the Communist Party has taken down his rivals. Two executives at , an indebted airline that once held a big stake in Deutsche Bank, have been arrested. The founder of Anbang, an acquisitive insurer, has received a lengthy prison sentence for financial crimes. So has the founder of Tomorrow Group, a banking-and-insurance empire.Mr Guo does not appear in imminent danger of sharing their fate. But his company is in trouble. On October 25th Moody’s, a ratings agency, downgraded Fosun’s debt deeper into junk territory. Chinese banks have been asking the firm to provide more collateral for loans. To meet its obligations Fosun has already divested $5bn-worth of assets this year, according to data from Refinitiv, a research firm. By 2023 it could shed $11bn-worth. That is quite the reversal for the asset-hungry group. It also marks the end of a freewheeling era in Chinese business, which is turning inwards under President Xi Jinping.