- by

- 01 30, 2025

-

-

-

Loading

Loading

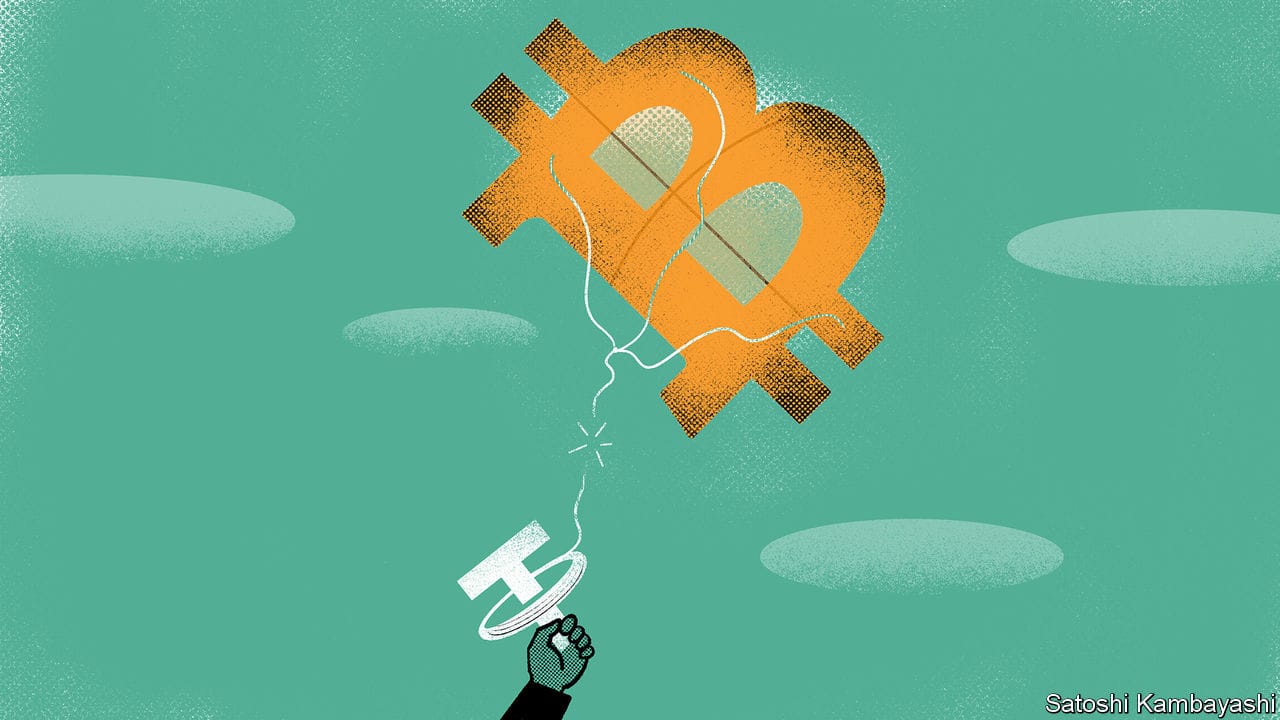

, or the first signs of a crypto-crash? On February 21st bitcoin hit a new high of more than $58,000, double its price at the start of the year, after several big firms and investors, led by Tesla, signalled that they were starting to take the cryptocurrency seriously. Within two days, though, the price had tumbled by over a fifth (before recovering slightly), jangling the nerves of ers, as bitcoin diehards are known. A trigger for the fall was Elon Musk, Tesla’s boss and bitcoin’s cheerleader-in-chief, musing that its price “seems high”. The news that Tether, an integral component of crypto-markets, had fallen foul of American regulators hardly helped calm the faithful.Tether is a so-called stablecoin. Its issuer, a company of the same name, has long claimed that Tethers—of which more than 34bn are in circulation—are backed one-to-one by dollars. One purported advantage of such pegging is lower volatility; bitcoin’s price, by contrast, is notoriously erratic. Another is that stablecoins make it easier to move between cryptocurrencies and the ordinary sort.