- by Amy Yee

- 01 15, 2026

-

-

-

Loading

Loading

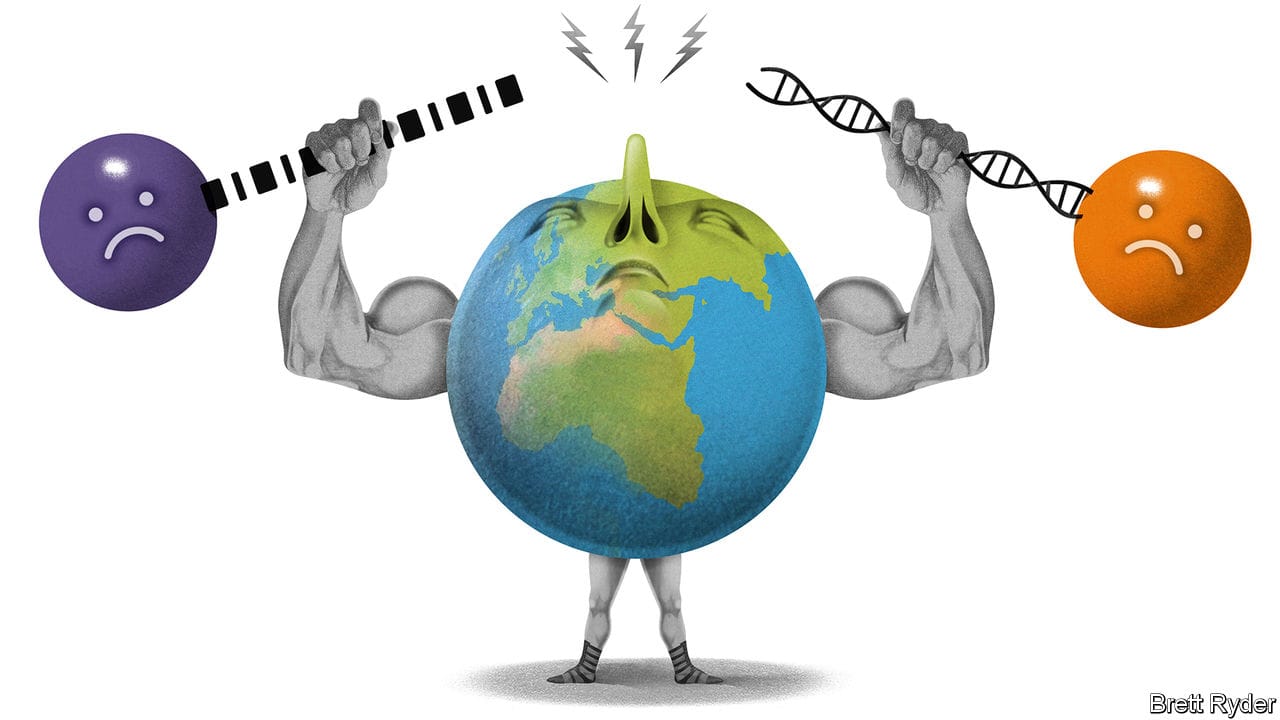

be the biggest industrial merger ever. In late 2000 General Electric (), the world’s most valuable company at the time, agreed to pay $43bn for Honeywell, a smaller American manufacturer of, among other things, aircraft electronics. Jack Welch, ’s and America Inc’s capitalist-in-chief, put off his retirement to see it through. The transaction, codenamed “Project Storm”, seemed a done deal. American authorities gave their blessing, finding no threat to competition ( made jet engines but not avionics). Regulators elsewhere were expected to defer to America in a merger involving two American firms. So it came as a shock when, in 2001, the European Commission killed it. A diversified would, the ’s competition watchdog argued, wield too much power in the market for aircraft parts. America’s trustbusters pooh-poohed the commission’s theory of “conglomerate effects”. The treasury secretary, Paul O’Neill, called the ruling “off the wall”. Now another transatlantic antitrust rift has opened up. In March 2021 America’s Federal Trade Commission () sued to stop the $7bn takeover by Illumina, a gene-sequencing giant, of Grail, maker of a cancer-detection test. The claimed Illumina risked withholding its sequencing technology from Grail’s rivals. On September 1st a judge at the agency’s internal court threw out the lawsuit, in part because Grail’s tests currently have no rivals to speak of. Then, on September 6th, the blocked the deal—never mind that Grail has no turnover in the bloc.