- by Yueqing

- 07 30, 2024

-

-

-

Loading

Loading

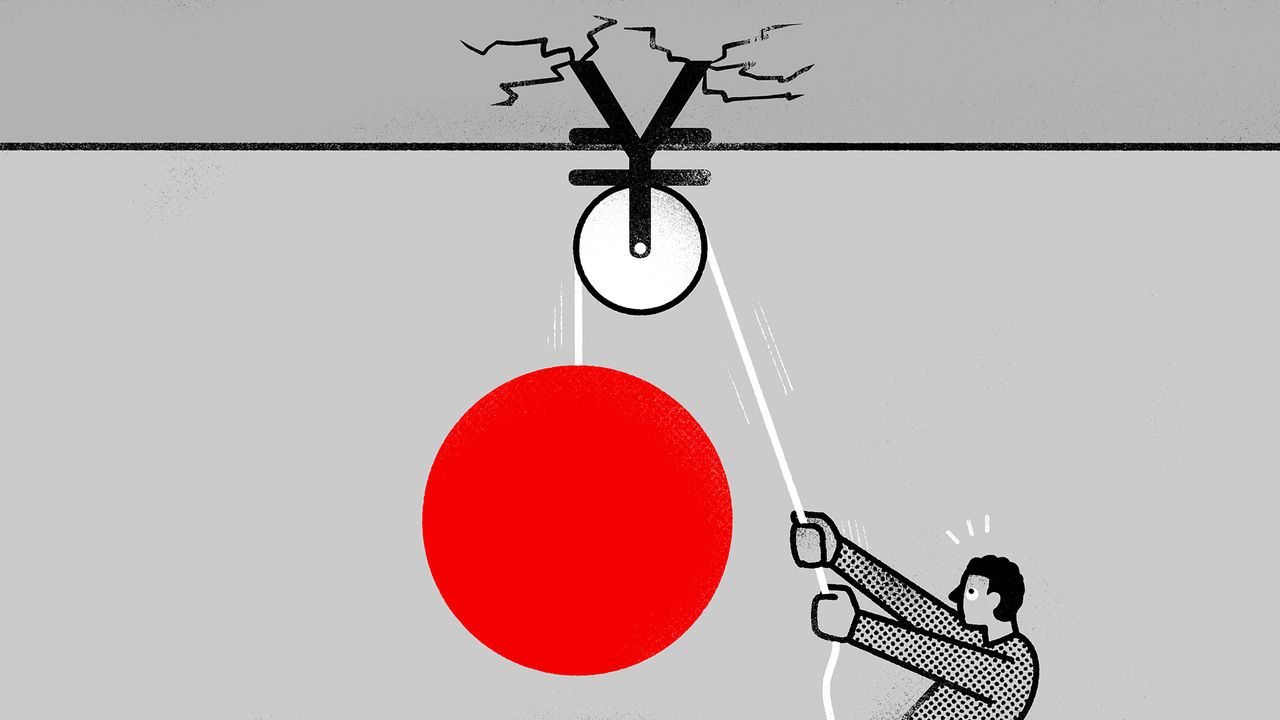

Foreign visitors have come flooding back to Japan since it reopened to travel in late 2022, making up for three years’ absence during the covid-19 pandemic. The weakness of the yen has produced some bargains for these recent arrivals. For the first time in a much longer period, investors are similarly excited about the bargains to be found in Japanese stockmarkets. Unfortunately, much like the travellers who zip through Tokyo in go-karts dressed as Mario and Luigi, many now risk going overboard in their newfound enthusiasm.From January to August foreigners bought ¥6.1trn-worth ($40bn-worth) of Japanese stocks, which represents the largest nominal inflow during the same timeframe since 2013. According to a survey by Bank of America, more fund managers are now overweight the country’s shares (ie, investing more than they usually would) than at any time in almost five years. The return of investors to Japan’s markets has been driven by optimism about reforms to corporate governance, with companies increasingly subject to investor activism and therefore returning cash. High-profile winning bets on Japan’s trading companies by Warren Buffett, a famous investor, have provided a boost. So has the fact that Japanese stocks have returned 13% this year, in dollar terms, compared with a 10% rise globally.