- by Amy Yee

- 01 15, 2026

-

-

-

Loading

Loading

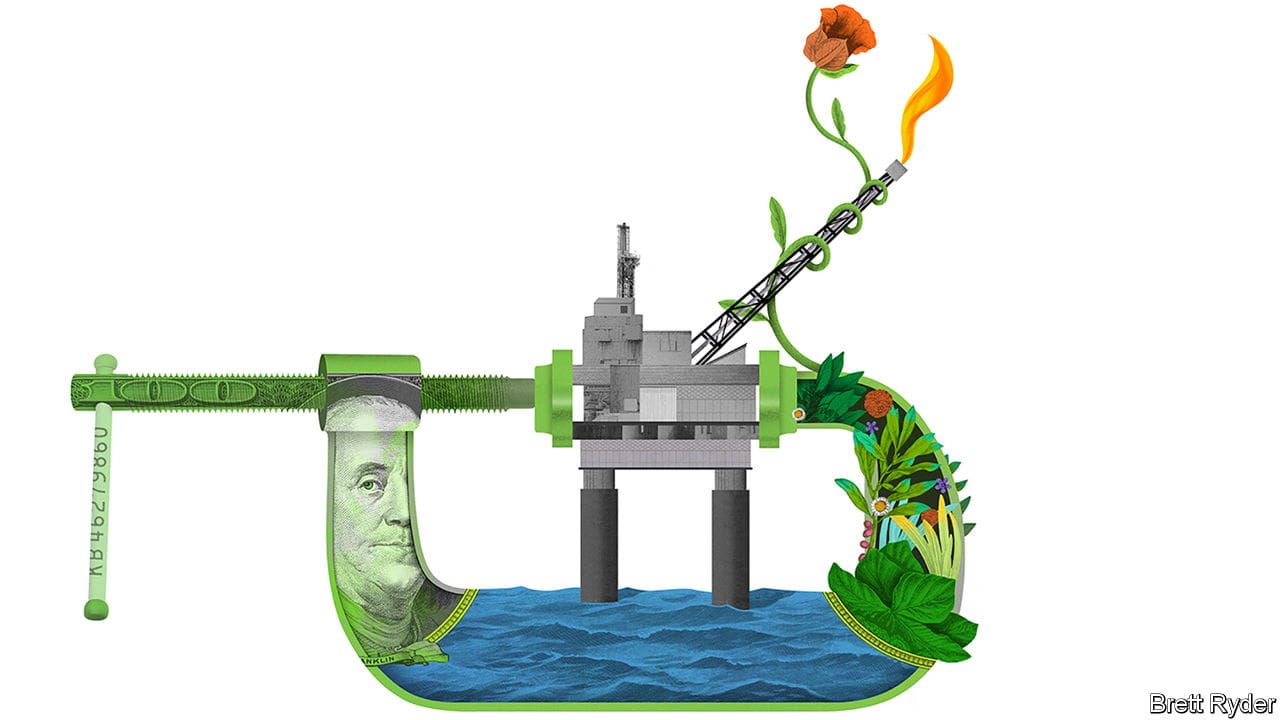

TWO AMERICAN giants, spooked by a crisis that has roiled oil markets, fall into each other’s arms. The tie-up strings back together bits of Standard Oil—broken up in 1911 in the world’s most famous trustbusting exercise. The year was 1999, and Exxon had just completed an $81bn merger with Mobil. Might history repeat itself in 2021? The world of corporate dealmaking is abuzz following reports that last year the bosses of ExxonMobil and Chevron discussed combining the two firms, clobbered by covid-19 along with the rest of their industry. The talks are off, apparently. But they could be rekindled. The resulting crude-pumping colossus could produce enough to meet over 7% of global oil demand.This time, though, the deal would not be a show of strength, especially for ExxonMobil. The company was under strain before the pandemic. Despite a $261bn capital-spending splurge between 2010 and 2019, its oil production was flat. Its net debt has ballooned from small change to $63bn, in part to maintain its sacrosanct dividend, which costs it $15bn annually. The company, which had a market capitalisation of $410bn ten years ago—and in 2013 was the world’s most valuable listed firm—is worth less than half that now. In a symbolic blow, last August it was ejected from the Dow Jones Industrial Average, after 92 years in the index.