- by Amy Yee

- 01 15, 2026

-

-

-

Loading

Loading

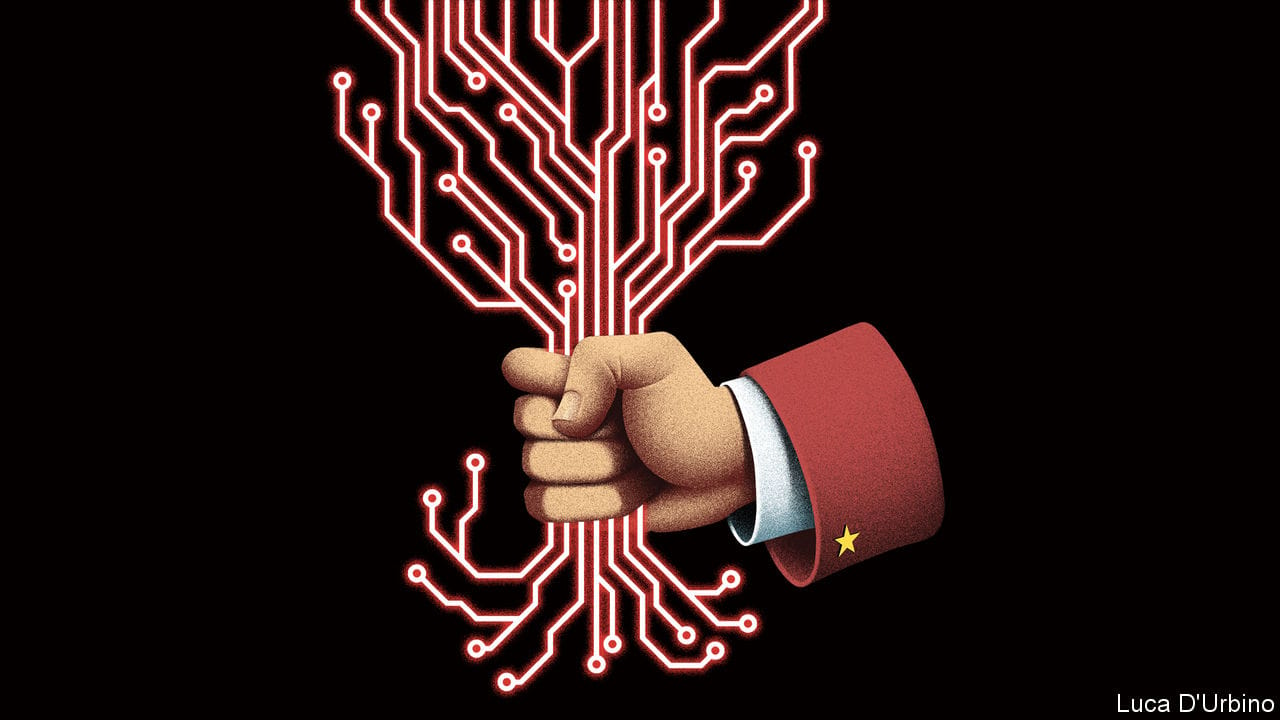

CHENG WEIIPOCACCAC, the billionaire founder and chief executive of Didi Global, had scarcely a moment to revel in his firm’s $4.4bn New York listing. Within 48 hours of the initial public offering (), which valued the Chinese ride-hailing giant at around $70bn, regulators in Beijing spoiled the party. On July 2nd the Cyberspace Administration of China () said it had launched an investigation into the company. The announcement shaved 5% off its share price.Two days later the regulator ordered Didi’s mobile app to be pulled from app stores in China, halting new customers from joining the service (existing users can still hail taxis). The alleges that Didi was illegally collecting and using personal data. Didi said that it would “strive to rectify any problems” but warned of “an adverse impact on its revenue in China”. Predictably, the ban also adversely affected the company’s market value. When American markets reopened on July 6th, Didi promptly shed more than a fifth of it. It is now worth $22bn less than a week go.