- by Amy Yee

- 01 15, 2026

-

-

-

Loading

Loading

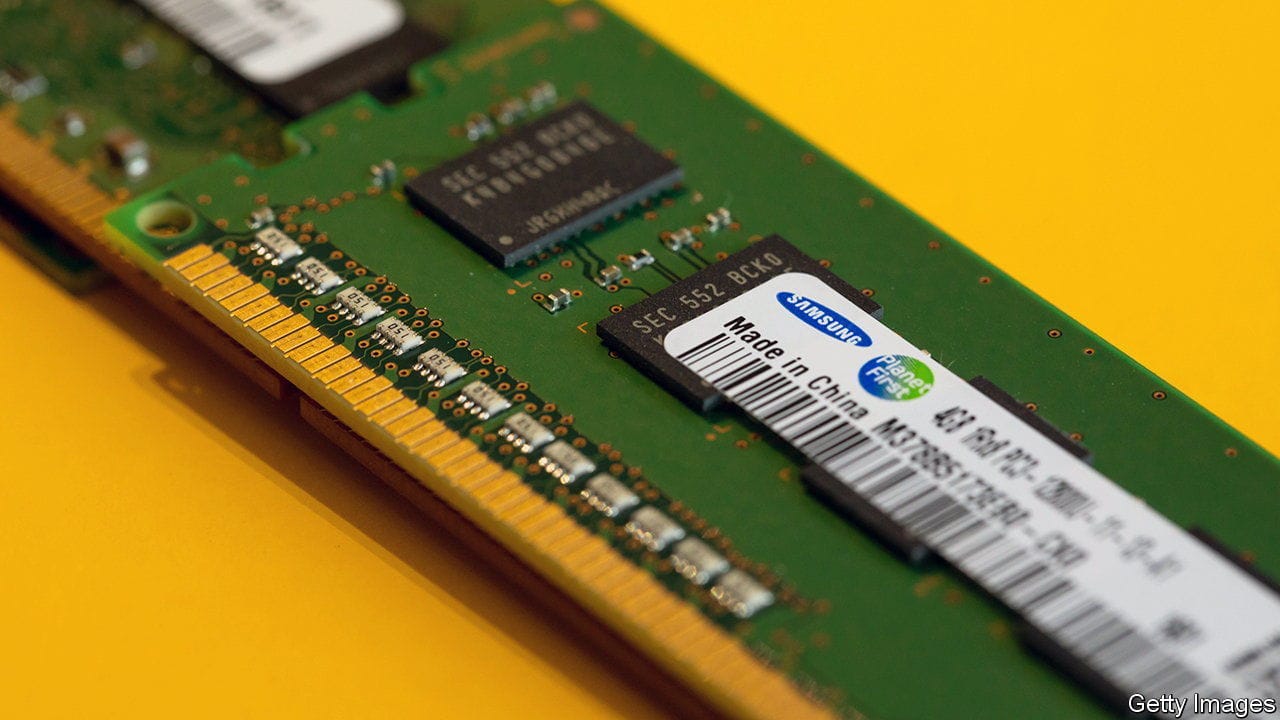

, computer chips are all the same: magical artefacts that permit smartphones to perform miraculous feats. Expert technologists instead see a diverse range of highly specialised products of human ingenuity, each with their own unique characteristics and function. Until recently investors in semiconductor companies behaved more like the uninitiated consumers, piling into virtually all chipmakers with the expectation of conjuring up preternatural returns. As the pandemic-era chip boom turns to bust, they are increasingly coming to resemble the discerning nerds.In particular, investors are distinguishing between firms whose fortunes are tied to “logic” chips, which process information, and the manufacturers of “memory” chips, which store it. Although demand for all types of semiconductors has cooled this year, the memory market is feeling considerably frostier than the one for logic. That in turn has opened up a geographical divide between the world’s silicon superpowers, South Korea and Taiwan—and between their respective semiconductor champions, Samsung and .