- by Yueqing

- 07 30, 2024

-

-

-

Loading

Loading

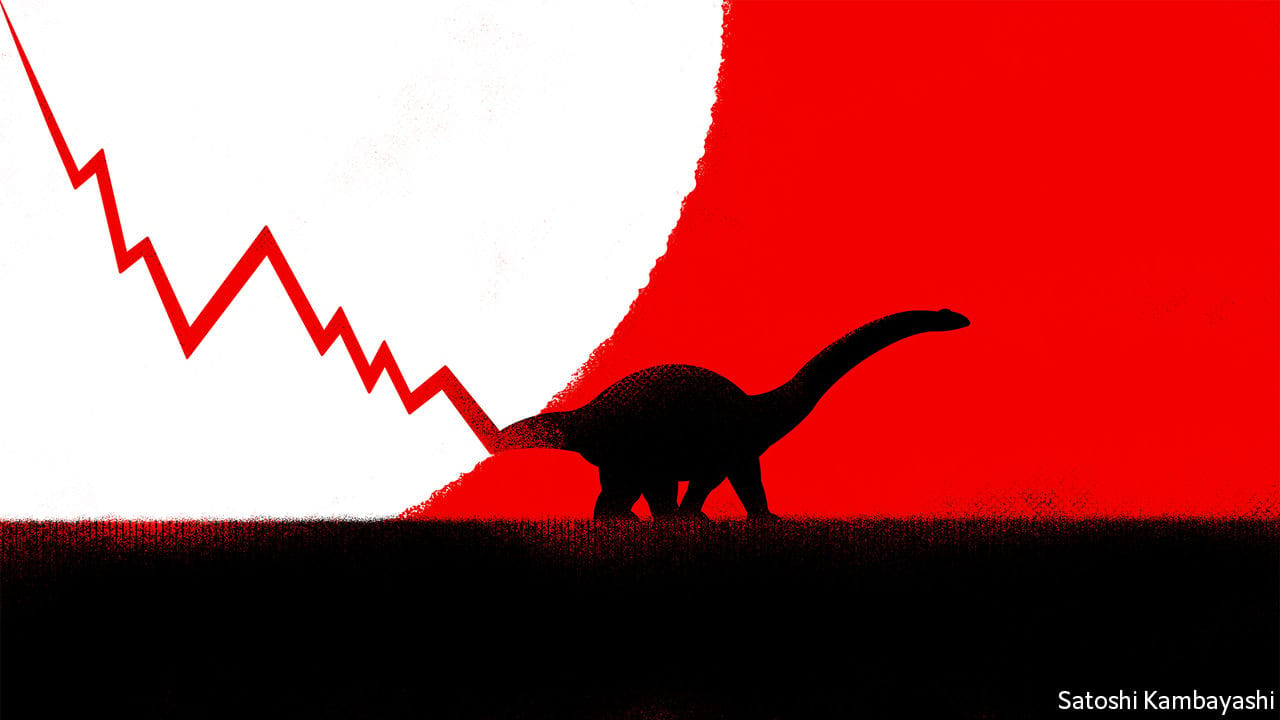

WRITING IN JULY 2007SPARKUS, the fund manager and bubble spotter Jeremy Grantham likened the stockmarket to a brontosaurus. Although credit markets were collapsing around him, share prices remained stubbornly high. It was as if the great sauropod had been bitten on the tail, but the message was still “proceeding up the long backbone, one vertebra at a time” towards its tiny brain. It took its time arriving: America’s & 500 index did not reach its nadir for another 20 months.The story so far this year has been different. Equities, particularly the more speculative ones, have had a brutal start to 2022. The tech-heavy Nasdaq Composite index fell by about 16% in January, before rallying a little. The Innovation fund, a vehicle devoted to young, high-risk tech stocks, declined by 20% last month, and is 53% below its peak in early 2021. Yet even the wilder parts of the credit markets remain comparatively serene. Bank of America’s high-yield index, a popular barometer for the price of “junk” bonds issued by the least credit worthy borrowers, has fallen by just 2.4% since late December.