- by

- 05 23, 2024

-

-

-

Loading

Loading

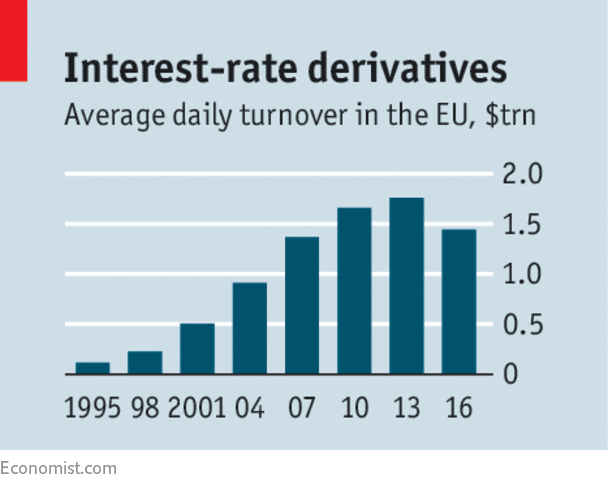

LIKE the clubs it sometimes resembles, the financial industry tends to discriminate against non-members—such as bank depositors, retail investors and small firms. The most pervasive form of discrimination is opacity: it is nearly impossible, say, for an average investor to know how much of the money in his pension pot is lost in transaction costs. As well as helping institutions milk their clients, opaque markets can cause or exacerbate crises when investors flee risks they cannot assess; witness the fate of mortgage-backed securities in 2007-08. So it is welcome that much post-crisis financial regulation aims to make markets more transparent. That was true both of the Dodd-Frank reforms in America and a huge new law in the European Union. As with Dodd-Frank, however, the benefits of Europe’s reform risk being drowned in its complexity.