- by Yueqing

- 07 30, 2024

-

-

-

Loading

Loading

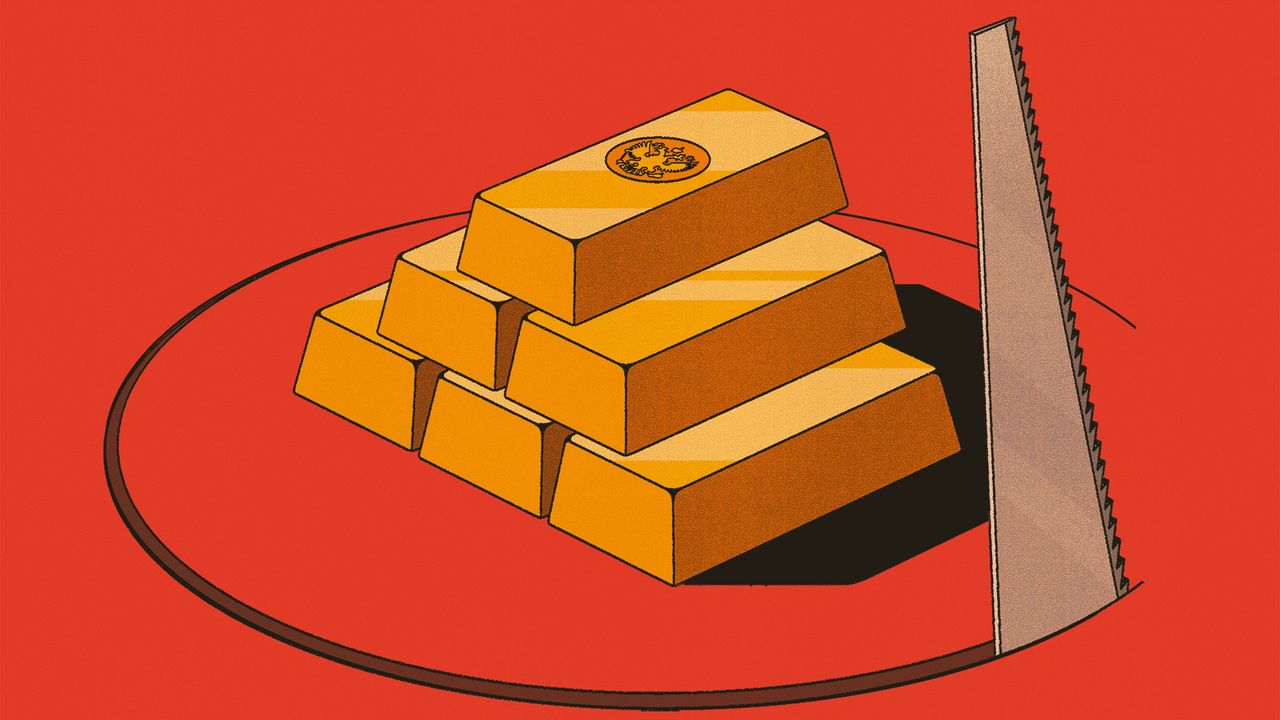

In economic termsCBR G, an asset has value because an owner might derive future benefits from it. Some assets, like cryptocurrencies, require a collective belief in those benefits. Others, like wine, will undeniably provide future pleasure, such as the ability to savour a 1974 Château Margaux. Still others, like American Treasuries, represent a claim on the government of the strongest economy in the world, backed by a formidable legal system.To derive such benefits, however, an owner must be able to access their assets. And that is where the Central Bank of Russia struggles. Much like every other central bank, the stores reserve assets abroad. After Vladimir Putin’s invasion of Ukraine in 2022, the 7 froze these assets and prohibited financial firms from moving them. Of the $282bn of Russian assets immobilised in Japan and the West, some $207bn (€191bn) are held at Euroclear, a clearing-house in Belgium. When coupon payments on Russia’s assets come due or bonds are redeemed, Euroclear puts the cash into a bank account. This account is now home to roughly €132bn. Last year it earned a return of €4.4bn, which conveniently belongs to Euroclear, as per the clearing-house’s terms and conditions.