- by Amy Yee

- 01 15, 2026

-

-

-

Loading

Loading

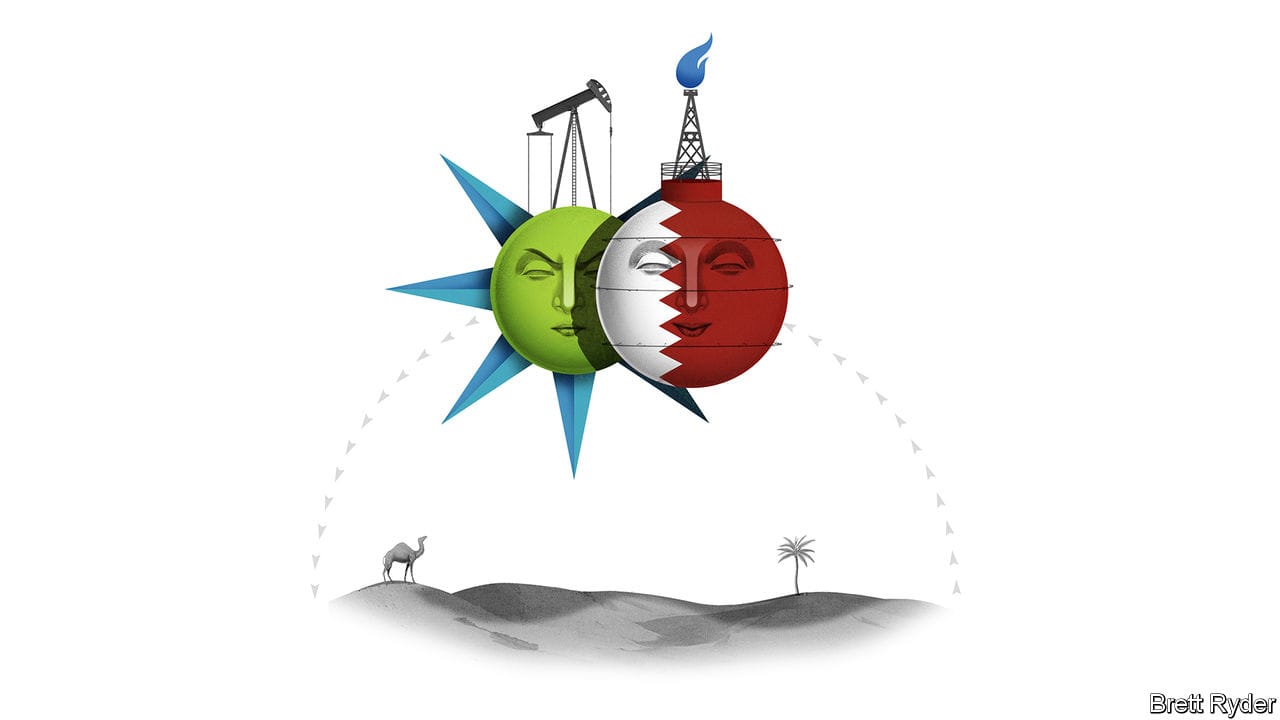

TO SAUDI ARABIA, Qatar is little more than a sore thumb sticking out into the Persian Gulf. For decades the kingdom has looked down on its neighbour as an irritating pipsqueak, with which it has little in common except the desert. Saudi Arabia has historically cut more of a dash in global affairs; the vast fields of natural gas that Qatar controls have never provided it the same clout as its rival’s oceans of oil. Saudi Aramco, which produces 12.8m barrels of oil equivalent per day, has just attained a market value of more than $2.3trn, making it the world’s second-most-valuable listed company after Apple. Alongside it, QatarEnergy, which produces less than a third as much, looks like an emir’s plaything. Now Russia’s war on Ukraine has also exposed a stark contrast in the attitude of the two countries to the world beyond their borders. Their different approaches to energy geopolitics could have big repercussions for both firms, as well as for the West and the East.Saudi Arabia undoubtedly believes it is on a roll—and in some ways it is. On March 20th Aramco, the world’s biggest oil exporter, revealed that soaring oil prices had enabled it to more than double net profit to $110bn in 2021, when crude averaged around $70 a barrel. With oil prices now above $100, the bonanza will grow. The company plans to raise capital expenditure to $40bn-50bn this year, up from $32bn in 2021. That will help it towards a goal of adding 1m barrels a day (b/d) of oil-production capacity by 2027.