- by Amy Yee

- 01 15, 2026

-

-

-

Loading

Loading

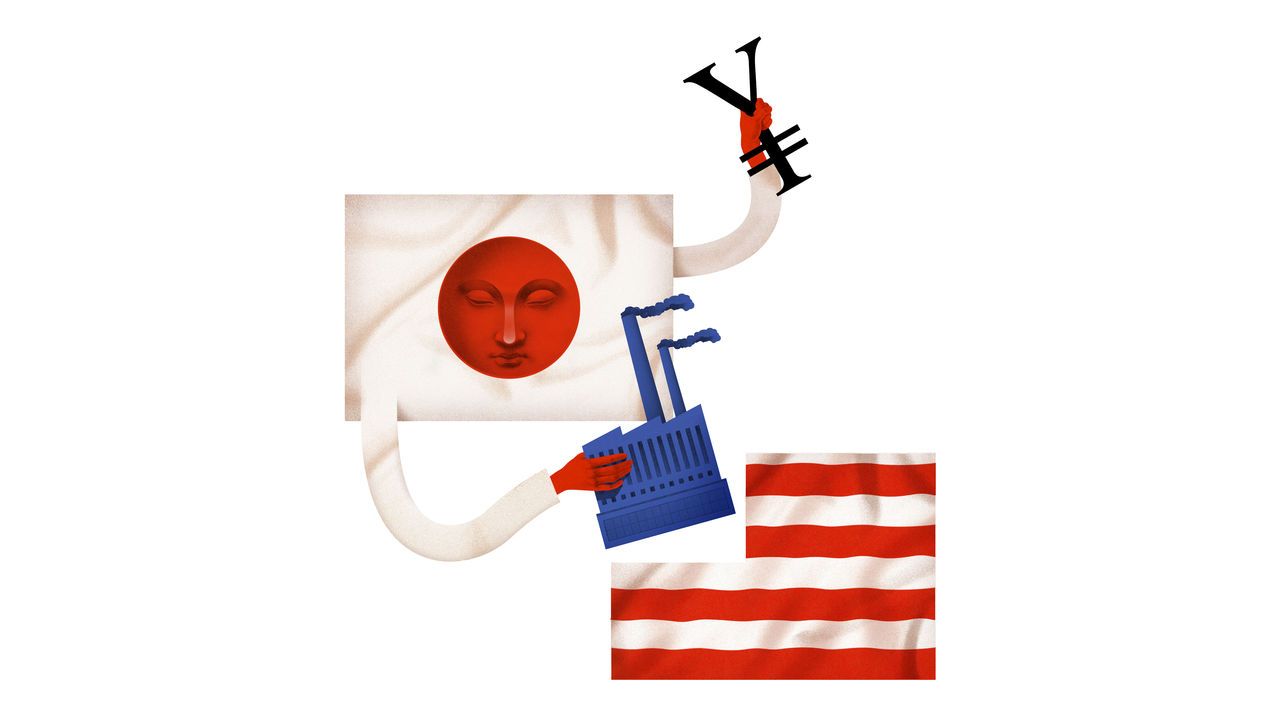

Last summerUSUSUSUSCFIUSUS Steel was considering taking the capitalists’ way out—by selling itself. American steelmaking has suffered decades of decline, ostensibly as a result of foreign competition. At home traditional integrated producers like Steel have been overtaken by “mini-mills” powered by electricity and non-union workers. In August Cleveland-Cliffs, a rustbelt rival, announced that it had made an offer to buy Steel and had been rebuffed. Dozens of suitors emerged. In December Cleveland-Cliffs made a final bid of $54 per share, to be paid in cash and stock.It was bested by, of all things, foreign competition. On December 18th Steel said it had agreed to be bought by Nippon Steel, Japan’s biggest steelmaker, for $15bn (or $55 per share) in cash. The offers from Cleveland-Cliffs and Nippon promised shareholders almost identical financial value, but came with very different risks. Combining with Cleveland-Cliffs would attract antitrust scrutiny; a fleet of carmakers complained that the merged company would dominate the automotive steel market. Selling to Nippon would rile politicians and require the blessing of the Committee on Foreign Investment in the United States (), America’s increasingly strident inbound-investment watchdog. Steel’s lawyers were sanguine about the risks of selling a corporate icon to a Japanese firm. Nippon won.