- by Amy Yee

- 01 15, 2026

-

-

-

Loading

Loading

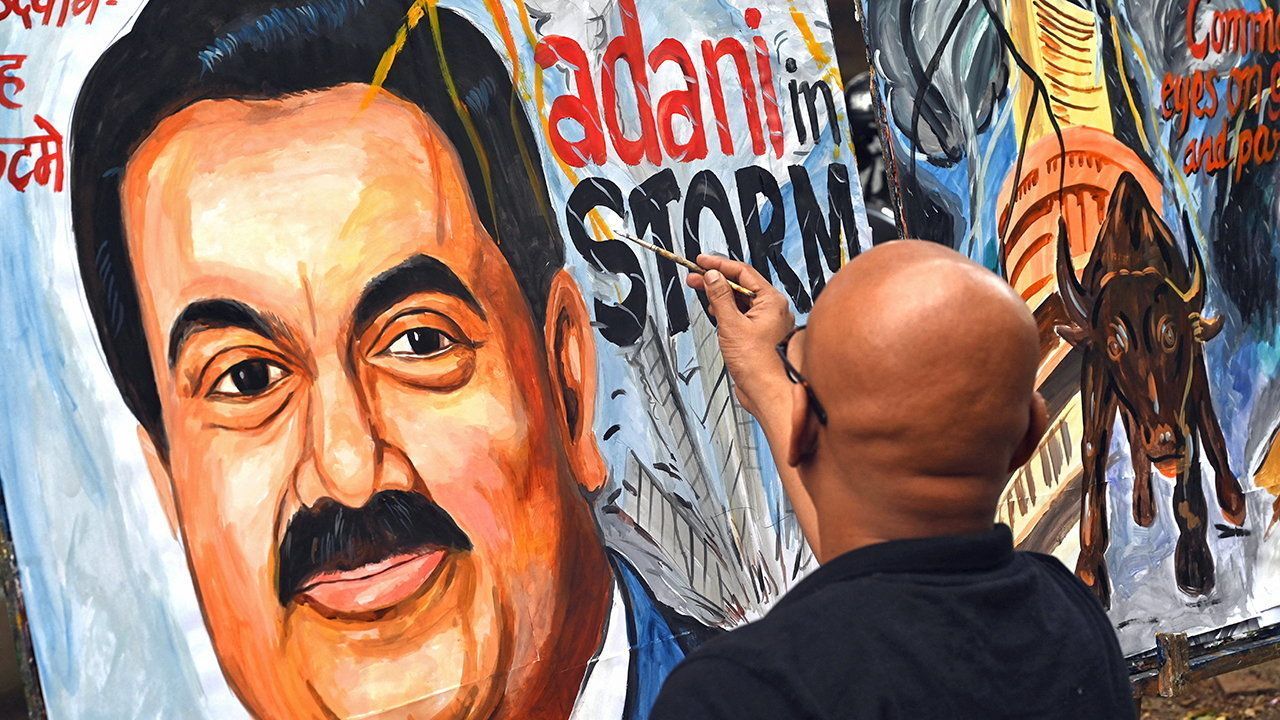

When a New York short-seller’s report wiped some $150bn, or two-thirds, from the combined value of the Adani Group’s listed holdings in late January and early February, several big questions were keeping India Inc up at night. Would Indian banks and insurance companies with significant exposure to the ports-to-power conglomerate also teeter? Would the contagion spread to the rest of the Indian financial world? And would India’s government pursue an aggressive investigation into the short-seller’s allegations of fraud and stockmarket manipulation, which set off the imbroglio (and which the Adani Group vehemently denies)?A month and a half on, the answers to the first two questions are, happily for India, “no”. The answer to the third is less categorical, and somewhat less constructive: the government seems in no rush to settle the matter, perhaps because the Adani firms’ modest free float means a small number of mostly big shareholders bore much of the pain and no angry mob of retail investors is pressing Delhi to get to the bottom of it, fast. With those big questions out of the way, attention has turned to the next conundrum: can the Adani Group and its eponymous tycoon founder, Gautam Adani, recover? Or will they founder, possibly dragging the Indian government’s grand plans for investments in infrastructure and green energy down with them?